Introduction

In today’s fast-paced business environment, maintaining accurate financial records is crucial for success. Companies are increasingly asking, “Can CRM track invoices and payment?” The short answer is yes. Modern Customer Relationship Management (CRM) software goes beyond managing customer interactions; it can also track invoices, payments, and even automate reminders. This ability can streamline accounting processes, reduce errors, and improve cash flow management.

Understanding CRM Beyond Sales

Customer Relationship Management software is often perceived solely as a tool for sales tracking and customer engagement. While its primary role is to manage relationships, CRM platforms have evolved into versatile business management tools. Many solutions now integrate financial modules that allow businesses to monitor invoices, track payments, and even analyze outstanding balances. The integration of financial tracking with CRM ensures that businesses have a holistic view of both customer interactions and financial health.

Why Financial Tracking Matters in CRM

Tracking invoices and payments is not just about keeping records; it’s about making informed business decisions. By integrating invoicing into CRM, companies can identify overdue payments, understand customer purchasing behavior, and forecast cash flow. This unified approach eliminates the need for multiple software tools, reducing complexity and the risk of data errors. Businesses that adopt this approach often see improvements in efficiency, accountability, and customer satisfaction.

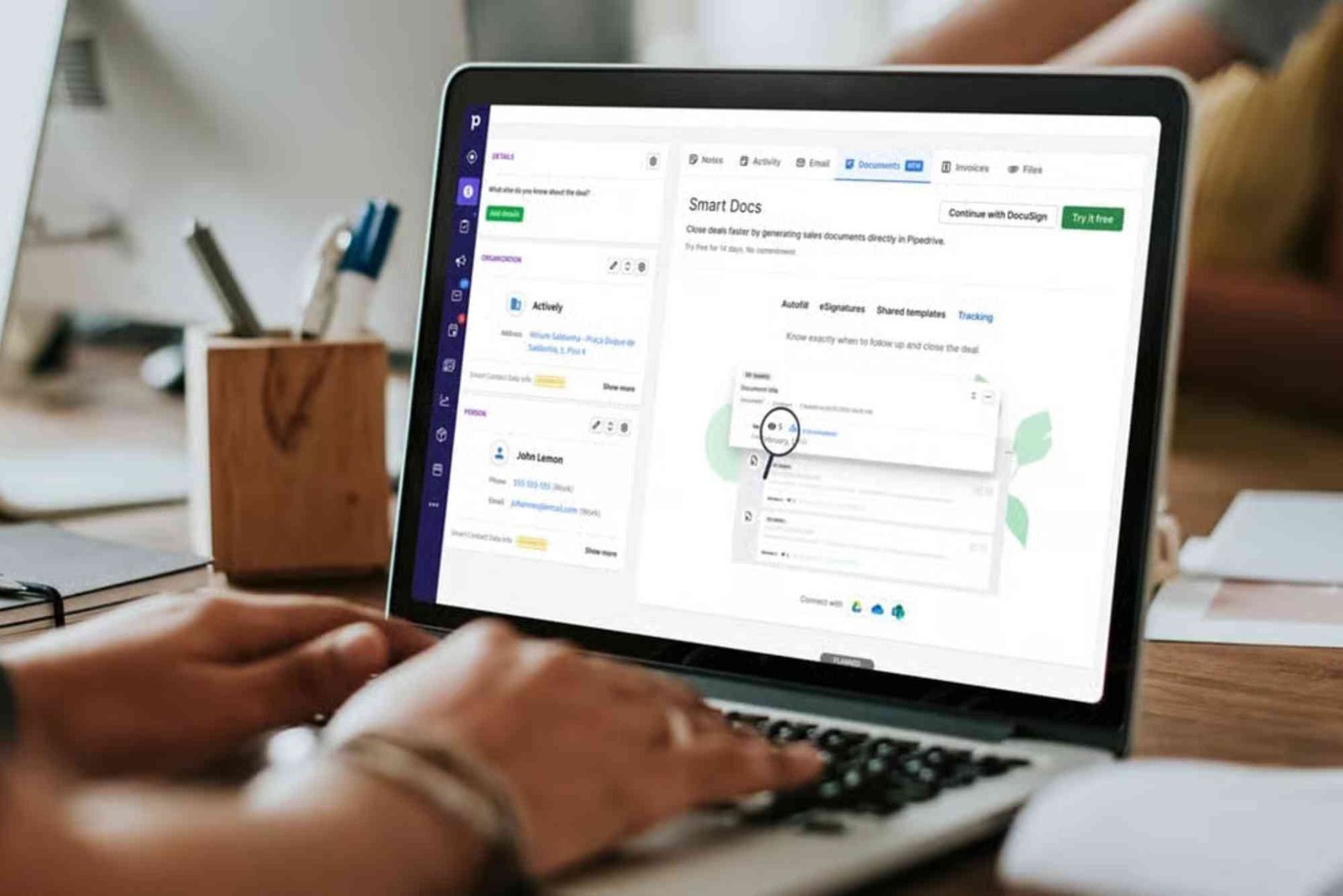

How CRM Tracks Invoices

Modern CRMs offer a variety of features to manage invoices. When a sales deal is closed, the CRM can automatically generate an invoice based on the transaction details. This invoice can then be sent to the customer directly from the CRM, saving time and ensuring consistency in communication.

Automatic Invoice Generation

Automatic invoice generation is one of the key advantages of using a CRM for financial management. Once a sale is recorded, the CRM can create an invoice with all necessary details such as product descriptions, pricing, taxes, and payment terms. This reduces human error and accelerates the billing process.

Real-Time Invoice Tracking

CRM systems allow businesses to track the status of invoices in real-time. Users can see which invoices are pending, partially paid, or overdue. This transparency helps finance teams take proactive measures, such as sending reminders or negotiating payment terms, to maintain healthy cash flow.

Integration with Accounting Software

Many CRMs integrate seamlessly with accounting software like QuickBooks, Xero, or Zoho Books. This integration ensures that invoices and payments are automatically synchronized across platforms, reducing manual data entry and improving accuracy. Companies can generate comprehensive financial reports without switching between multiple tools.

How CRM Tracks Payments

Beyond invoicing, CRMs can also track payments efficiently. Payment tracking within a CRM provides visibility into customer transactions, helping teams stay on top of their accounts receivable.

Payment Status Updates

CRM platforms can automatically update payment status once a transaction is completed. Whether a payment is made via credit card, bank transfer, or digital wallet, the system records it immediately. This feature helps finance teams avoid chasing down payments unnecessarily and maintains accurate financial records.

Payment Reminders and Notifications

One of the significant advantages of using CRM for payment tracking is automated reminders. Companies can set up the CRM to send reminders before the payment due date, reducing late payments and improving cash flow. Notifications can also alert managers about overdue payments, enabling timely follow-up actions.

Reporting and Analytics

CRM software often includes reporting and analytics tools that allow businesses to monitor payment trends. For instance, users can track which customers frequently pay late, analyze the average payment cycle, and identify potential risks. These insights help in strategic decision-making and improving overall financial health.

Benefits of Using CRM for Invoices and Payments

Using CRM to track invoices and payments provides several tangible benefits that can transform business operations.

Improved Efficiency

By consolidating customer management, invoicing, and payment tracking into a single system, businesses reduce time spent on repetitive tasks. Automated invoice creation and payment updates free teams to focus on strategic work, like improving customer relationships.

Enhanced Accuracy

Manual invoicing is prone to errors, such as incorrect amounts, missing details, or duplicate entries. CRM software minimizes these errors by automating invoice generation and payment tracking, ensuring financial accuracy and reducing disputes with clients.

Better Cash Flow Management

Monitoring payments and outstanding invoices in real-time enables businesses to manage cash flow proactively. Timely reminders and status tracking help ensure that payments are received promptly, reducing the risk of liquidity issues.

Stronger Customer Relationships

When businesses can track invoices and payments efficiently, they create a smoother customer experience. Automated invoices and timely follow-ups demonstrate professionalism, enhancing trust and satisfaction.

Choosing the Right CRM for Invoice and Payment Tracking

Not all CRMs are created equal, and selecting the right one is crucial for seamless invoice and payment management. Businesses should look for the following features:

Financial Module Integration

A CRM with built-in or easily integrable financial modules is essential. This ensures invoices, payments, and reports are managed from a single interface, streamlining workflows.

Automation Capabilities

Automation features, including invoice generation, payment reminders, and status updates, are crucial. They save time, reduce errors, and improve cash flow management.

Analytics and Reporting

Powerful reporting and analytics tools allow businesses to gain insights into payment patterns, overdue invoices, and customer behavior. This data-driven approach supports better financial planning and decision-making.

User-Friendly Interface

Ease of use is critical. A CRM with an intuitive interface ensures that finance teams and sales representatives can adopt it quickly without extensive training, improving overall efficiency.

Real-World Applications

Many businesses successfully use CRM for invoice and payment tracking. For example, service-based companies like marketing agencies, software developers, and consultancies benefit from tracking multiple clients’ invoices within the same system. E-commerce businesses also integrate payment tracking to monitor orders, refunds, and pending balances efficiently.

Streamlining Operations

By linking sales pipelines with financial tracking, companies eliminate the need for manual reconciliation between CRM and accounting software. This streamlines operations and provides a single source of truth for both customer and financial data.

Boosting Revenue Collection

When invoices and payments are tracked effectively, businesses are more likely to collect revenue on time. Automated reminders and insights into overdue accounts help finance teams take proactive measures, reducing late payments.

In conclusion, the answer to “Can CRM track invoices and payment” is a definitive yes. Modern CRM platforms go beyond customer management to offer robust financial tracking features. By automating invoice generation, monitoring payment status, sending reminders, and providing analytics, CRMs streamline financial operations and improve cash flow management. Businesses that leverage CRM for invoice and payment tracking enjoy enhanced efficiency, accuracy, and stronger customer relationships. Investing in the right CRM system is a step toward operational excellence and financial stability.

If you want to optimize your financial processes and enhance customer management, explore how a CRM can integrate your invoicing and payment workflows seamlessly. Start today and experience the benefits of streamlined financial management. Explore our Related Blog article for more insights on business efficiency and growth. Learn more about advanced CRM features to maximize your operations.

Businesses looking to enhance their financial management should consider a CRM capable of tracking invoices and payments effectively. This integration simplifies operations, improves cash flow, and strengthens customer relationships. Discover more insights on optimizing your business processes and enhancing customer engagement through our Can CRM Track Invoices And Payments.

FAQs

Can CRM generate invoices automatically?

Yes, most modern CRMs can automatically generate invoices once a sale is recorded, ensuring consistency and reducing errors.

Does CRM track payment status in real-time?

Absolutely. CRMs update payment status immediately after a transaction, helping businesses monitor accounts efficiently.

Can CRM send payment reminders to customers?

Yes, automated reminders can be set up to notify customers about upcoming or overdue payments, improving cash flow.

Which CRMs are best for invoice and payment tracking?

Popular options include Salesforce, Zoho CRM, HubSpot, and Freshsales, especially those with integrated financial modules.

Is CRM integration with accounting software necessary?

While not mandatory, integrating CRM with accounting software like QuickBooks or Xero ensures synchronized data and minimizes manual entry.