Introduction

In today’s fast-paced business environment, managing finances accurately and efficiently is essential. Many organizations rely on Customer Relationship Management (CRM) systems to not only handle customer interactions but also streamline financial processes. This raises a crucial question: Practical Tips: Can Crm Track Invoices And Payments? Understanding how CRM systems can handle invoicing and payment tracking is vital for improving cash flow, reducing errors, and enhancing customer satisfaction.

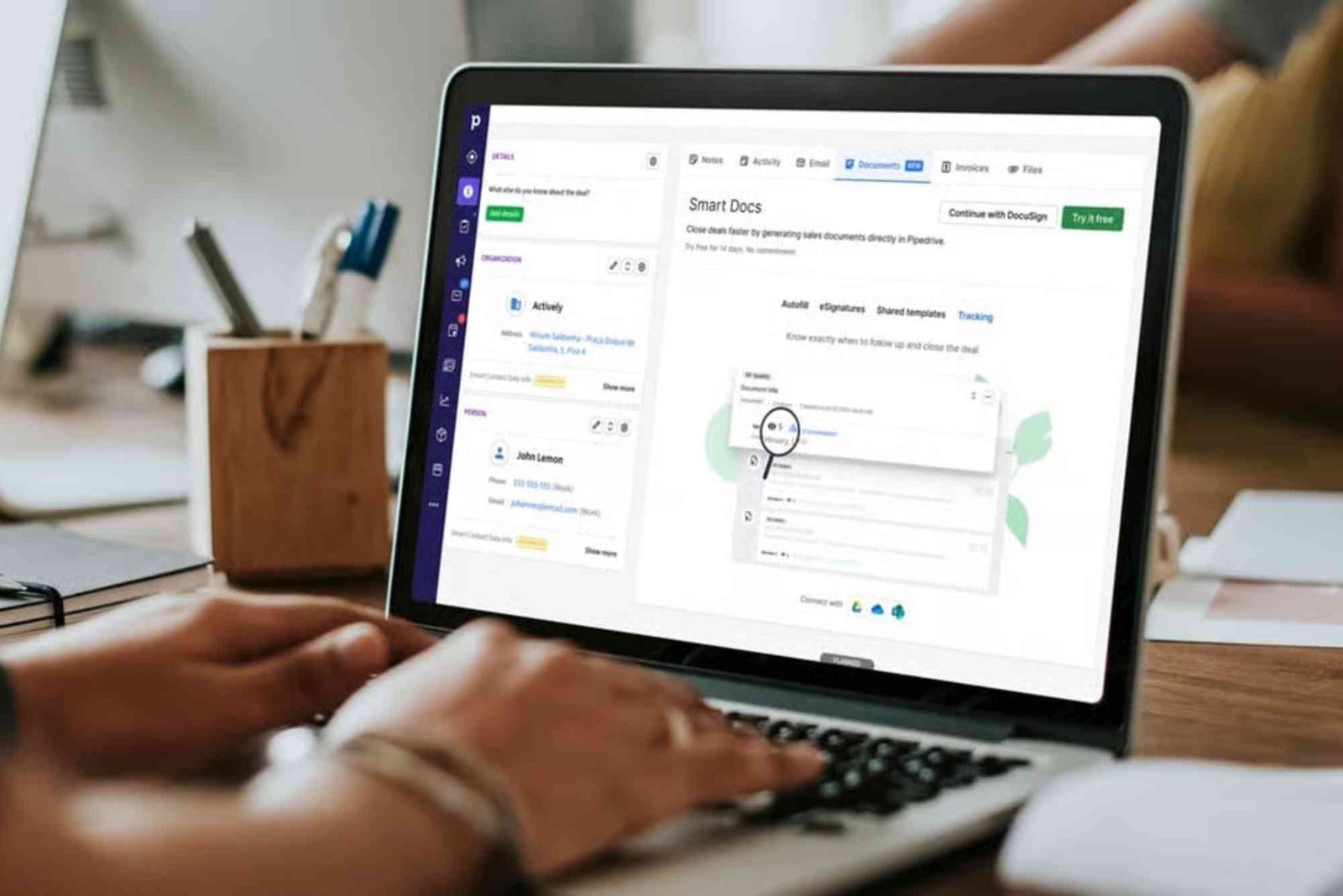

CRM systems have evolved significantly over the past decade. Once primarily used for sales tracking and customer support, modern CRMs now integrate financial management features. From generating invoices to monitoring overdue payments, these tools provide businesses with a centralized platform for both customer data and financial activities. Let’s dive deeper into how CRMs can simplify invoice and payment management while offering practical tips for maximizing their efficiency.

How CRMs Integrate Financial Management

Modern CRMs offer more than contact management. They often include modules or integrations for invoicing, payment tracking, and accounting. The level of sophistication varies depending on the software, but even basic CRMs can offer substantial benefits for small and medium-sized businesses.

Invoice Creation and Customization

One of the key financial features in CRMs is invoice creation. Users can generate professional invoices directly from the system using pre-designed templates. Customization options allow companies to include logos, payment terms, and itemized billing details. This ensures consistency in branding and reduces manual entry errors.

Some CRMs also support automated invoice generation based on recurring billing cycles. This feature is especially useful for subscription-based services or companies that handle multiple clients with regular payments. By automating invoices, businesses save time and minimize the risk of overlooking billing schedules.

Payment Tracking and Notifications

Beyond creating invoices, CRMs can monitor payment statuses in real-time. Once an invoice is sent, the system can track whether it has been paid, is pending, or overdue. Automated reminders and notifications can alert both staff and clients about upcoming or overdue payments. This proactive approach reduces late payments and improves overall cash flow management.

Integrating CRM systems with payment gateways further enhances efficiency. Online payments can be processed directly through the CRM, automatically updating the invoice status. This seamless connection eliminates the need for manual reconciliation between banking records and customer accounts.

Reporting and Analytics

CRMs provide detailed reporting and analytics on financial activities. Businesses can quickly access summaries of outstanding invoices, total revenue, and payment histories. By analyzing these insights, companies can identify patterns in customer payments, forecast cash flow, and make informed decisions about credit policies.

Additionally, reporting tools can help management understand which products or services generate the most revenue. This data-driven approach ensures better allocation of resources and prioritization of high-performing clients or projects.

Practical Tips for Using CRM to Track Invoices and Payments

Successfully leveraging CRM systems for financial management requires more than just installation. Here are practical tips to optimize invoice and payment tracking.

Keep Customer Data Updated

Accurate customer information is the backbone of effective invoicing. Ensure that all contact details, billing addresses, and payment preferences are current. This reduces the likelihood of delays caused by incorrect information and ensures that invoices reach the right recipients.

Automate Recurring Invoices

For businesses with recurring services, automation is key. Set up recurring invoices for regular clients to save time and minimize human error. This approach also allows staff to focus on other critical tasks rather than manually generating multiple invoices each month.

Integrate Payment Gateways

Integrating popular payment gateways with your CRM allows clients to pay directly through invoices. This integration speeds up payment processing and automatically updates the invoice status within the CRM. Clients appreciate the convenience, and businesses benefit from improved cash flow management.

Use Alerts and Reminders

CRMs can send automated reminders to clients about upcoming or overdue payments. Configure alerts for internal teams as well, ensuring that staff follow up promptly. This proactive communication reduces the risk of late payments and strengthens client relationships.

Customize Reports

Regularly generate and analyze financial reports to track invoice and payment trends. Customize these reports to focus on overdue invoices, high-value clients, or specific billing periods. This strategic approach helps identify areas where intervention is needed and supports better financial planning.

Train Your Team

Even the most sophisticated CRM system is only as effective as its users. Provide training for employees on invoice management features, payment tracking, and report generation. Ensuring that your team is confident in using the system maximizes its value.

Regularly Audit Financial Data

Periodically review your CRM’s financial data to verify accuracy. Check for duplicate entries, incorrect amounts, or missing invoices. Regular audits prevent discrepancies and maintain trust between your business and clients.

Benefits of Tracking Invoices and Payments in CRM

Using CRM systems for financial management offers several advantages beyond convenience.

Centralized Financial Management

A CRM consolidates customer interactions and financial transactions in one platform. This centralization reduces the need to switch between multiple tools, saving time and minimizing errors.

Enhanced Accuracy

Automated invoice generation and payment tracking significantly reduce manual errors. By relying on the CRM for calculations and reminders, businesses ensure that financial records are accurate and up-to-date.

Improved Cash Flow

Monitoring invoices and payments in real-time allows businesses to act quickly on overdue accounts. Faster collection cycles enhance cash flow, enabling companies to reinvest in growth initiatives.

Better Customer Relationships

Timely and accurate invoicing fosters trust with clients. CRM systems can also personalize reminders and messages, creating a professional and customer-focused experience.

Data-Driven Decision Making

Access to detailed financial reports empowers managers to make informed decisions. Businesses can identify trends, predict future revenue, and adjust strategies to optimize profitability.

Common Challenges and How to Overcome Them

While CRMs offer extensive benefits, businesses may encounter challenges when tracking invoices and payments.

Integration Issues

Not all CRMs seamlessly integrate with accounting software or payment gateways. Choosing a CRM with compatible integrations or using middleware solutions can solve this problem.

Data Accuracy

Incomplete or outdated customer data can lead to errors in invoices and payment tracking. Regularly updating records and validating information minimizes these risks.

User Adoption

Employees may resist adopting new CRM features for financial management. Providing training, creating clear processes, and demonstrating the benefits encourages consistent usage.

Customization Limitations

Some CRMs may not offer the level of invoice customization a business requires. Evaluate CRM options carefully before implementation to ensure they meet financial management needs.

Choosing the Right CRM for Invoice and Payment Tracking

Selecting a CRM system that effectively tracks invoices and payments requires consideration of several factors. Look for a CRM that supports invoice creation, integrates with payment gateways, provides automated reminders, and offers robust reporting features. Additionally, ensure that the platform is user-friendly and scalable to accommodate business growth. Exploring trial versions or demos can help evaluate whether the system aligns with your operational requirements. For more insights, check out this Related Blog article.

Future Trends in CRM Financial Management

The capabilities of CRMs continue to expand. AI-driven automation, predictive analytics, and blockchain integration are increasingly influencing invoice and payment tracking. Artificial intelligence can predict late payments, suggest follow-up actions, and even automate dispute resolution. Blockchain technology promises enhanced security and transparency in financial transactions. Staying updated on these trends ensures that businesses leverage the full potential of CRM systems for financial management.

Practical Tips: Can Crm Track Invoices And Payments shows that modern CRM systems are powerful tools for managing both customer relationships and financial operations. From automated invoice generation to real-time payment tracking and detailed reporting, these platforms streamline financial processes while enhancing accuracy and efficiency. Implementing practical strategies such as keeping customer data current, automating recurring invoices, integrating payment gateways, and training staff ensures businesses maximize the benefits of CRM financial management.

Investing in a reliable CRM system and using it strategically can transform how a business handles invoicing and payments. Explore your options today, and embrace the convenience and efficiency that CRM systems offer. To Learn more about modern business tools and financial management, visit trusted resources for expert insights.

If you are ready to improve your financial tracking and streamline your operations, consider exploring various CRM solutions. Can Crm Track Invoices And Payments is not just a question—it’s a pathway to smarter, more efficient business management.

FAQ

Can CRM systems generate recurring invoices automatically?

Yes, most modern CRMs allow automated generation of recurring invoices for clients with regular billing cycles.

Is it possible to track overdue payments in a CRM?

Absolutely. CRMs can monitor overdue payments, send reminders, and update invoice statuses in real-time.

Can CRMs integrate with payment gateways?

Yes, many CRMs support integrations with popular payment gateways for seamless online payment processing.

Do CRM financial reports improve decision-making?

Yes, detailed reports provide insights into revenue trends, outstanding invoices, and customer payment patterns.

Is training necessary for using CRM invoice features?

Yes, training ensures that staff can effectively generate invoices, track payments, and use reporting tools.

What are the key benefits of using CRM for invoices and payments?

Centralized management, improved accuracy, better cash flow, stronger customer relationships, and data-driven decisions.