Cryptocurrency has become a hot topic in India, with more people showing interest in this digital asset. Cryptocurrency in India refers to the various digital currencies like Bitcoin, Ethereum, and others that are increasingly popular among Indian investors.

The appeal lies in the potential for high returns, the decentralization of financial transactions, and the global nature of cryptocurrency markets. However, the journey to buying cryptocurrency in India involves understanding various aspects, from legalities to the actual purchase process.

Understanding the Legal Landscape of Cryptocurrency in India

Before diving into the world of cryptocurrency, it’s crucial to understand its legal status. The legal landscape of cryptocurrency in India has been evolving over the years. Initially, there was a lot of uncertainty, but the Reserve Bank of India (RBI) lifted the ban on cryptocurrency trading in 2020. Currently, while cryptocurrency in India is not illegal, it is not yet regulated, and the government is working on framing laws to oversee its use. Staying informed about any legal developments is essential for anyone looking to invest in cryptocurrency in India.

Choosing a Cryptocurrency Exchange in India

The first step to buying cryptocurrency in India is selecting a cryptocurrency exchange. A cryptocurrency exchange is a platform where you can buy, sell, and trade digital currencies. When choosing an exchange, consider factors like security, ease of use, transaction fees, and the variety of cryptocurrencies offered. Some of the most popular exchanges in India include WazirX, CoinDCX, and ZebPay. Comparing these platforms in terms of user experience, fees, and customer support can help you make an informed choice.

Creating an Account on a Cryptocurrency Exchange

Once you’ve selected a cryptocurrency exchange, the next step is to create an account. The process is straightforward and involves providing your personal information and verifying your identity. This Know Your Customer (KYC) process is mandatory for buying cryptocurrency in India and involves submitting documents like your PAN card, Aadhaar card, and bank details. This verification process ensures that all transactions are secure and comply with the regulations governing cryptocurrency in India.

Securing Your Cryptocurrency Wallet

After setting up your account, it’s essential to secure your cryptocurrency. A cryptocurrency wallet is a digital tool that allows you to store your cryptocurrencies safely. There are different types of wallets available in India, including hardware wallets, software wallets, and mobile wallets.

Each has its own level of security. For example, hardware wallets are considered the most secure as they store your private keys offline. Securing your cryptocurrency in India means taking steps to protect your private keys and using trusted wallets to prevent unauthorized access.

Funding Your Account and Buying Cryptocurrency

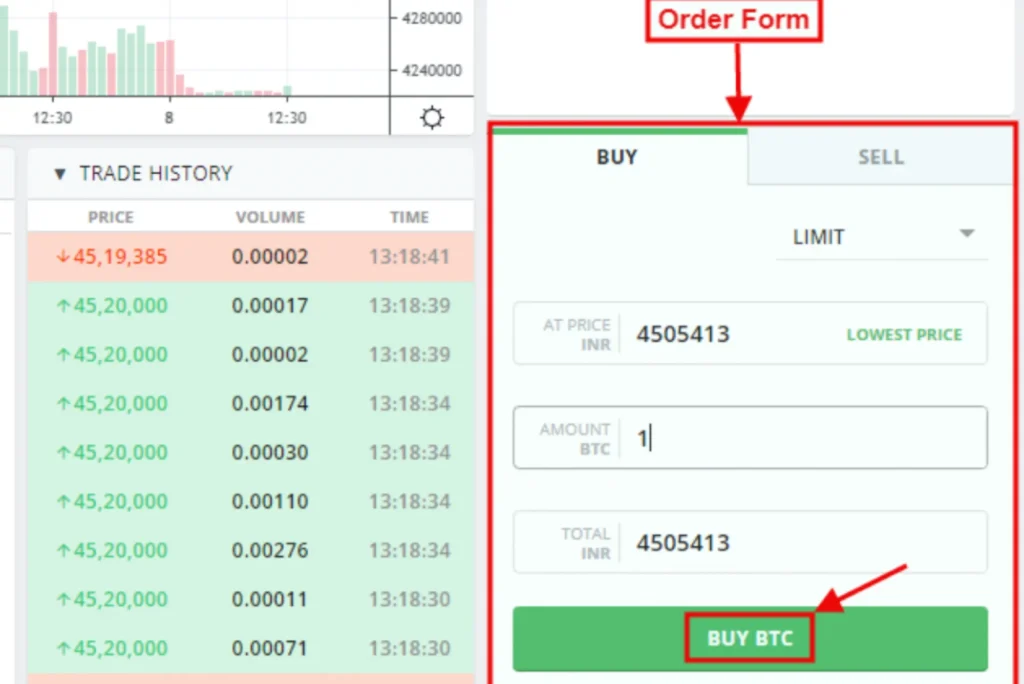

With your account set up and secured, you’re ready to buy cryptocurrency. The first step is to fund your exchange account with INR (Indian Rupees). Most cryptocurrency exchanges in India offer multiple payment methods, including bank transfers, UPI, and even credit/debit cards.

After depositing funds into your account, you can choose the cryptocurrency you want to buy. The process is usually as simple as entering the amount you wish to purchase and confirming the transaction. This step officially marks your entry into the world of cryptocurrency in India.

Storing and Managing Your Cryptocurrency

Once you’ve purchased cryptocurrency, the next step is to store and manage it. It’s recommended to transfer your cryptocurrency from the exchange to your personal wallet for added security. Regularly monitor your cryptocurrency portfolio to keep track of your investments.

In India, several tools and apps can help you manage your cryptocurrency holdings, track prices, and even set alerts for market changes. Proper management and storage are crucial to securing your cryptocurrency in India.

Common Mistakes to Avoid When Buying Cryptocurrency in India

As with any investment, buying cryptocurrency in India comes with its risks. Some common mistakes to avoid include investing more money than you can afford to lose, failing to secure your wallet, and not staying updated with legal developments. It’s also important to avoid falling for scams or phishing attempts, which are prevalent in the cryptocurrency market. By being cautious and informed, you can avoid these pitfalls and make wiser investment decisions.

The Future of Cryptocurrency in India

The future of cryptocurrency in India looks promising but uncertain. As the government works on introducing regulations, the market is expected to become more stable and secure. Cryptocurrency in India could potentially offer new opportunities for investment and financial growth.

However, challenges such as regulatory changes, market volatility, and security concerns remain. Keeping an eye on these developments is crucial for anyone invested in the future of cryptocurrency in India.

Buying cryptocurrency in India is an exciting venture that requires careful planning and understanding. From choosing the right exchange to securing your assets and staying informed about legal changes, each step is crucial for success. As cryptocurrency continues to grow in popularity, being knowledgeable about how to buy, store, and manage it will position you well in the evolving landscape of cryptocurrency in India.